Are you tired of juggling multiple accounts to keep track of your finances? Or maybe you don’t even know where to begin? The budgeting app, Mint Premium, is the perfect solution to get a clear, real-time overview of your finances.

Whether it’s tracking your day-to-day expenses or setting up budgets and goals for the future, Mint has everything you need in one powerful app.

When I made a big career change in January 2023, without a doubt I knew getting my finances in order was essential.

I didn’t know the first thing about budgeting or my spending habits.

I downloaded the personal finance app from the Apple app store and signed up for the premium version.

It’s been almost a year using the budgeting app and I’d like to share my mint app review.

What is Intuit Mint Premium?

Intuit Mint Premium is a personal finance management tool designed to help you effortlessly track, manage, and plan your financial life all in one place.

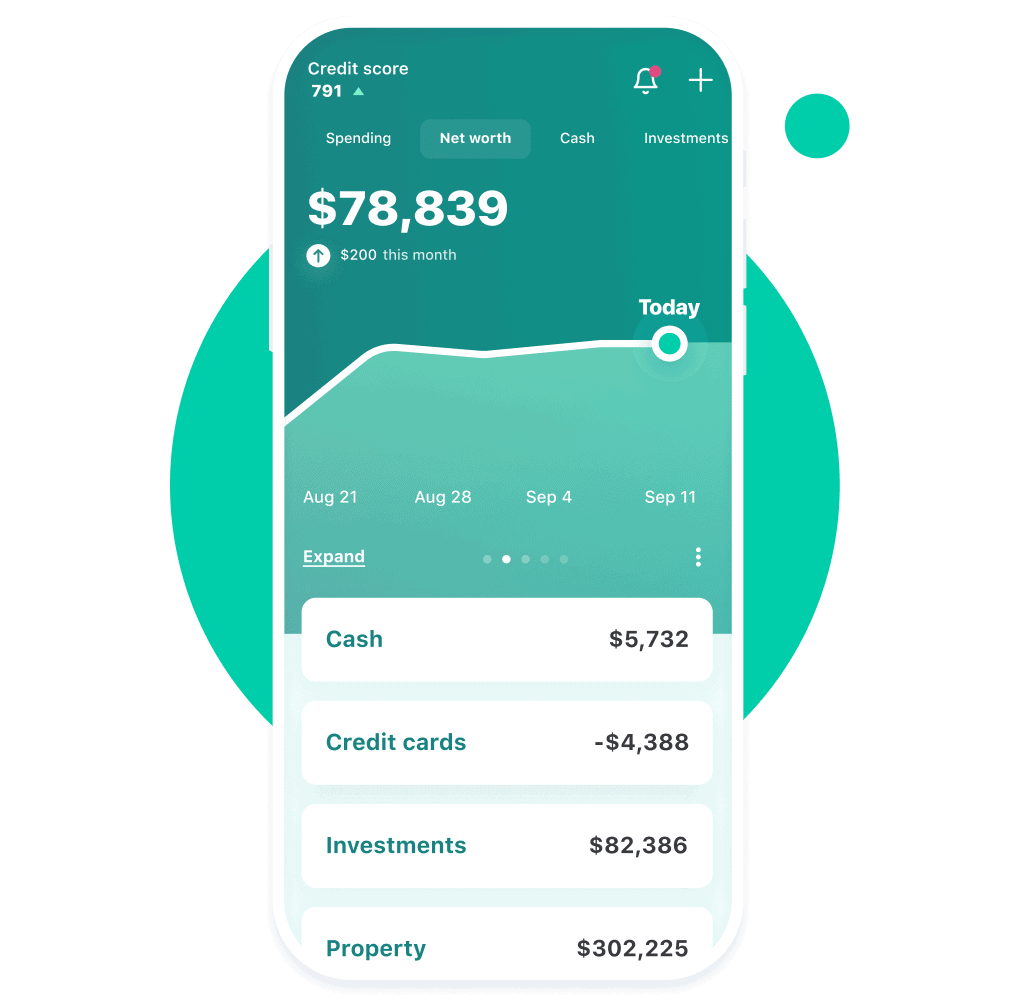

This premium subscription to the popular free Mint app offers a host of advanced features, including priority customer support, unlimited budgets, custom categories, and the ability to track your net worth.

Also, the app centralizes all your financial data, from bank accounts and credit cards to loans and investments, providing a holistic view of your financial situation.

Who Created Mint Premium?

Mint Premium is a product of Intuit Inc., a financial software company based in Mountain View, California.

Founded by Scott Cook and Tom Proulx in 1983, Intuit has a long-standing reputation for creating cutting-edge financial management tools. The company is best known for software products such as QuickBooks, TurboTax, and of course, Mint.

Their commitment to making finance easy for everyday people shines through in Mint Premium, which takes the hassle out of managing money, making it a top choice for first-time budgeters like me.

What are The Top Benefits of a Mint Premium Subscription?

The Mint budgeting app offers the following features that make budgeting uncomplicated. Here are some of the major benefits:

Holistic Financial Management

Mint Premium centralizes all your financial accounts, making it easier than ever to see the big picture. With investments, bills, brokerage accounts, and more all in one place, you can make informed decisions quickly.

I’ve never had one central spot to see it all, so this mobile app gave me that clarity.

In addition, I know some may feel bullish on linking everything, but it provides mint users with bank-grade security.

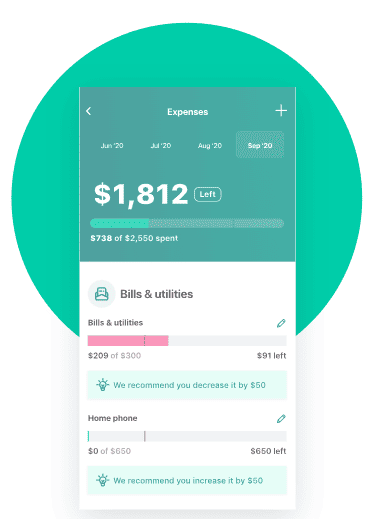

Advanced Budgeting

With unlimited budgets and custom categories, you gain complete control over your finances. It’s simple to allocate funds, track spending, and stay on top of your goals.

Previously, I never used a budgeting app so learning about my spending habits allowed me to gain valuable insights.

Net Worth Tracking

Mint’s Premium version allows you to assess your overall financial health by tracking your net worth and the trends that go along with it.

You can add your bank and investment accounts, but I do like you can link your property too.

Anything from vehicles to homes, the mint budgeting app shares the projected value which is interesting. Particularly, for homes you can see your latest zillow estimate.

Priority customer support

Although I’ve never had to use it (knock on wood), it’s nice to have assistance available.

Mint users get priority when they need help, ensuring that any issues are resolved quickly and effectively. Furthermore, I browsed their support page and it’s loaded with questions and responses.

I couldn’t find a phone number to call, but their chat is available seven days a week, 5 AM-5 PM PT.

Plus, if you ever need to get back into your account because you are locked out – they have dedicated recovery forms available.

Categorized Expenses

This feature is a favorite of the budgeting app. Mint Premium automatically categorizes transactions from linked credit cards and bank accounts, making it easier to see where you’re spending your money.

All categories come from the main list provided in Mint, but you can change the category of your transactions.

For example, Mint may think all my Costco purchases are “shopping” but I want them to be used as “groceries”.

I can create a rule for all future Costco trips to be listed under groceries.

Easy peasy!

Free Credit Score Checks

With your Mint premium account, you receive free credit score access, which can be crucial in maintaining good credit health and planning future financial endeavors.

I’ve never had a bad credit score, but it’s nice to understand where I stand on that scale. On the credit score tab, you’ll be able to look at several credit monitoring tools like the age of credit or credit inquiries.

There are high-impact areas like on-time payments and credit utilization that affect that number.

Plus, mint users are entitled to a free credit report every year sourcing from each of the three reporting agencies at annualcreditreport.

How much does Mint Premium cost?

The cost for Mint Premium starts at $4.99 a month.

Priced at $59.88 per year, Mint’s Premium annual subscription is more affordable than many other budgeting apps. Mint also offers an ad-free version for $0.99 a month.

Personally, I can’t stand when my downloaded apps are displaying targeted ads, so I’d pay regardless to do without.

However, the free version still offers a wide range of features. Ultimately, the choice depends on your specific personal finance needs.

My Personal Experience with Mint Premium

I hate to admit this, but I never had a great pulse on how much I spent monthly.

I have always been aware of my balance as well as certain significant expenses such as our mortgage and daycare. However, I never had a comprehensive understanding of the entire financial situation.

So many people are in the same boat as myself. I surveyed a lot of my mom friends just on their monthly grocery budget, and they couldn’t even tell me a number.

It made me feel connected and less alone.

At this time, I made a scary leap from a cushion salary job to be a freelancer. You can read more about that here, but with a dip in income, I had to get serious about budgeting.

My husband works full time, but we have three kids and a dog which subsequently brings lots of expenses.

With the downloaded personal finance app, I used the first few months to get a baseline of what I was spending. I was tracking expenses from everything via Amazon to grocery trips.

Remember, you can’t set a budget if you don’t even have a starting point for your regular habits.

After 6+ months of using Mint Premium, I gained so many valuable insights into our financial health.

For one, I started exclusively shopping for groceries at Aldi. I realized all the name-brand stuff was eating into our costs. Also, with just a few taps to conveniently purchase items from Target or Amazon, I was giving into impulse shopping way too much.

Do the boys need more clothes just because they are on sale? No. Do I need that house decor item some influencer shared? Big fat no.

So not only does Mint Premium give me knowledge of my personal finance health, but also motivates me to reevaluate future purchases.

Overall, I’m happy I started using the budgeting app and recommend other first-time budgeters look into it.

Mint Premium Pros and Cons

Mint Premium has a variety of features that can give you a comprehensive look at your finances. Here are some of the pros and cons to consider before taking the plunge:

Product Pros

Product Cons

Mint Premium Alternatives

For many people, the Mint app may not be the best fit. Here are some alternatives to consider:

- Acorns: Acorns is a microinvesting app that helps users invest spare change and offers portfolio advice.

- You Need a Budget (YNAB): YNAB uses an innovative zero-based budgeting approach that can help.

- Qapital: Qapital is a financial app aimed at helping users save money. It offers budgeting, savings, and investment tools to help users achieve their financial goals. Additionally, Qapital also has features such as automatic transfers and personalized savings rules.

- Empower: Empower is a powerful budgeting and financial management app that helps users reach their goals. It offers features such as automatic transfers, bill reminders, and real-time spending tracking.

Should You Buy Mint Premium?

Whether you’re a first-time budgeter or a seasoned financial planner, Mint Premium provides a comprehensive toolkit to manage your money more effectively.

It offers a range of features from budgeting and tracking to free credit score checks.

Plus, its relatively affordable price point makes it an attractive option for many users.

Ultimately, Mint Premium could be the right choice for you if you’re looking for a comprehensive financial management tool with plenty of features. Give it a try and see how it can help take your finances.

Frequently Asked Questions

Is Mint Premium worth it?

Yes, Mint Premium offers a comprehensive and user-friendly financial planning toolkit. It’s worth the cost if you are looking for an easy way to track your budget, save money, and build wealth.

How can Mint Premium help with saving money?

Mint Premium provides helpful saving and spending tips, including suggestions on how to save money and create a budget plan. It also helps users track their spending so they can see where their money is going. Additionally, Mint Premium offers free credit score checks to help users better manage their credit health.

Is Mint Premium secure?

Yes, Mint Premium uses bank-level encryption and is monitored 24/7 for suspicious activity.

Is Mint easy to use?

Mint Premium has an intuitive interface that makes budgeting and tracking expenses easy. It also has helpful resources, such as videos and articles, to help first-time budgeters get started.

How will Mint Premium help me build wealth?

Mint Premium provides advice on how to save money and invest for the future. It also offers free credit score checks to help users better manage their credit health

How does Mint Premium categorize my transactions?

The popular app’s transaction naming updates are based on the popularity of names and categories by other Mint users. You can always customize your purchases or set rules to rename anything.